KEWOTA SHARED SERVICES

Kewota Shared Services is a subsidiary company of KEWOTA that provides its members with low-interest loans, special insurance packages, and laptop ownership opportunities to facilitate their personal and economic growth.

WHY KEWOTA SHARED SERVICES

KEWOTA as an association is fully focused on the welfare of women teachers. KEWOTA does this through programs that enhance the living standards of women in the teaching profession by providing avenues for professional, economic, and personal development.

The activities of KEWOTA are guided by a constitution, and KEWOTA is not a profit making organization. KEWOTA has been partnering with other like minded partners both NGO’s and private sector institutions so as to ensure consistent service delivery to its members.

In order to enhance service delivery and provide products and services specifically tailored for women teachers, the association registered KEWOTA SHARED SERVICES as a subsidiary company under the umbrella of KEWOTA. This company has a dedicated team that focuses on innovative products and services tailored for women teachers, while the parent organization and leadership focuses on the welfare of its members.

Kewota Shared Services is a company limited by guarantee. This means that it is not a private entity. It is owned by the association. The directors of the company can only be signatories during their official tenure.

KEWOTA SHARED SERVICES was launched on 25th February 2023. The first products to be launched are microfinance services, Insurance services and Laptop ownership lipa mdogo mdogo program.

KEWOTA MICROFINANCE - TUINUANE DADA

Kewota microfinance is one of the three top products to be launched under KEWOTA shared services. This product is inspired by the truly independent modern woman. We believe in personal independence for modern women, that is why we give women teachers access to customized financial products that enable them to pursue their aspirations and attain their objectives by creating additional income streams.

Under KEWOTA microfinance we have three products.

- Chama loan

- Check Off loan

- Check book loans

CHAMA LOAN

Chama loan is a loan given to a group of women teachers under our table banking programs. We give this loan to women teacher groups who already have an active table banking group and want to increase cash flow or venture into business projects for their table banking groups. KEWOTA already has more than 30 table banking groups, and to be a member of this groups you must be a KEWOTA member so as to enjoy this financial product.

How it works

- Women teachers form a table banking group and elect their Chairlady, treasurer and secretary. Groups can be formed by women teachers from the same school, area and county.

- The group members contribute seed money to start their table banking.

- KEWOTA assists the table banking group to get a bank account. To facilitate this, its recommended that the group always writes minutes during its meetings, and keeps proper records of transactions.

- Group presents its project proposal or intention to borrow, and fills the loan application form

- KEWOTA Microfinance approves loan and disbursement is done within 24hrs.

*Terms & Conditions Apply

CHECK OFF LOAN

This product is for the individual member who is looking for a financial boost to fast track personal projects or have an emergency that needs urgent financial facilitation. Due to the urgency of this loan, approval is done within 12 hours. This product is available for members receiving a salary through TSC or any county government or Institution with an MOU with KEWOTA.

How it works

- Member fills in loan application form.

- Member submits a 3 months payslip, KRA pin and passport photo.

- Loan goes through review and approval process.

- Member receives funds

LOG BOOK LOAN

For members who would like a lending facility and the pay slip is already exhausted or needs a larger amount of funds that the pay slip can not accommodate.

How it works

The member fills the application form and submits the following documents

- One year bank statement

- 3 months recent pay slips

- Business visit report either by a Kewota coordinator or a loan officer

- Valid log book for a car – year of manufacture 2014 onwards

- If the log book is in another person name, signing of guarantee documents and identification documents of the guarantor.

Upon review the loan is approved within 24 hrs.

KEWOTA insurance agency

At KEWOTA’s heart, is the welfare and wellness of its members. Female teachers who wake up early, toil hard, leave their families behind and travel long distances under unfavourable weather conditions, all this to instil knowledge and mould the characters of our children all over the country.

As they perform their duties, sometimes unfortunate incidents happen. This incidents are inevitable, but to get through them, one needs support. That is why at KEWOTA, we make sure our sisters are fully supported by a network of fellow colleagues under KEWOTA. As we make sure you are psychologically and socially supported, you need financial and medical support to get back up and keep working. That is why we have the KEWOTA Insurance agency.

KEWOTA insurance agency is fully registered, and is in partnership with major insurance underwriters. Our insurance agency educated members on various issues to do with insurance, goes through policies to advice our members on all terms and conditions, and ensures our members receive the best insurance covers and claims are paid without struggle.

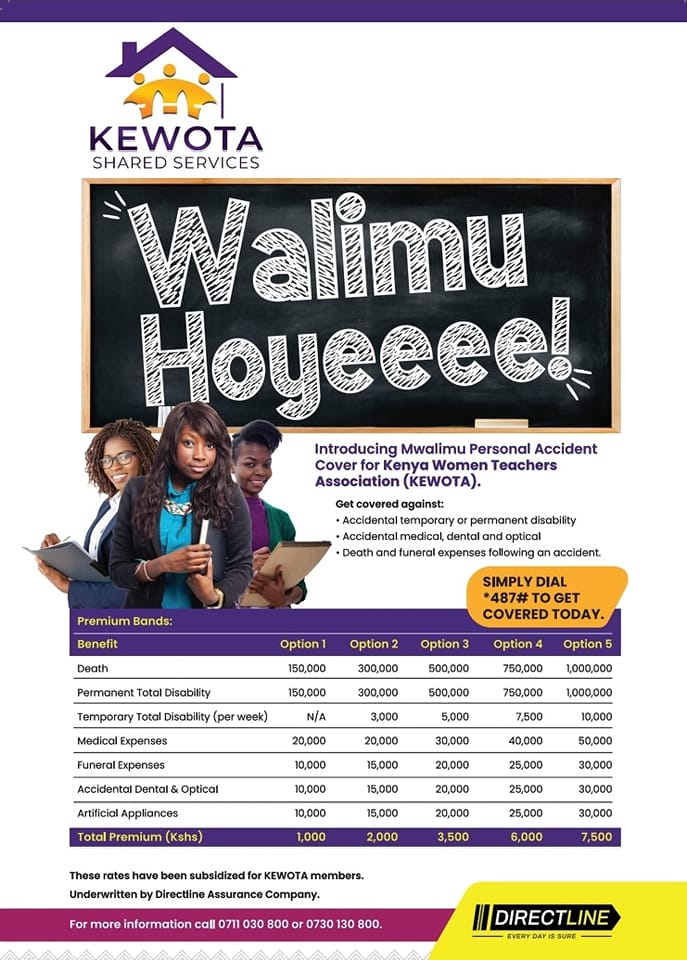

Under KEWOTA insurance agency, we have also launched our own innovative products purely tailored for our members. This products are Mwalimu PA, and Mwalimu Motor.

MWALIMU PA

Mwalimu PA means Mwalimu Personal Accident Cover. This product is for KEWOTA members only and is provided by Directline Insurance, and managed by KEWOTA.

This personal accident cover is available for all teachers who are members of KEWOTA. On their commutes to work, teachers use motorbikes, taxis and other means of transport that are available especially in mashinani areas. This vehicles are covered, but the teacher is not covered encase of minor or major accidents. That is why KEWOTA provided this cover at very low payments that are not available anywhere else.

For as low as Ksh 1000 PER YEAR, a teacher is fully covered and can access as much as 150,000 as a payout.

This product has options which a teacher can choose from based on budget and needs, and is fully available online.

Options and benefits include:

How it works

For this product, a teacher must be a member of the Kenya Women Teachers Association.

To access this product:

- Dial *487# and select Insurance

- Select Mwalimu PA

- Chose your option

- View policy details and select 98

- Select start cover today

- Input your TSC number

- Enter your EMAIL address

- Accept

- Confirm your details and enter your MPESA pin.

- You are now full covered. You will receive your policy via email.

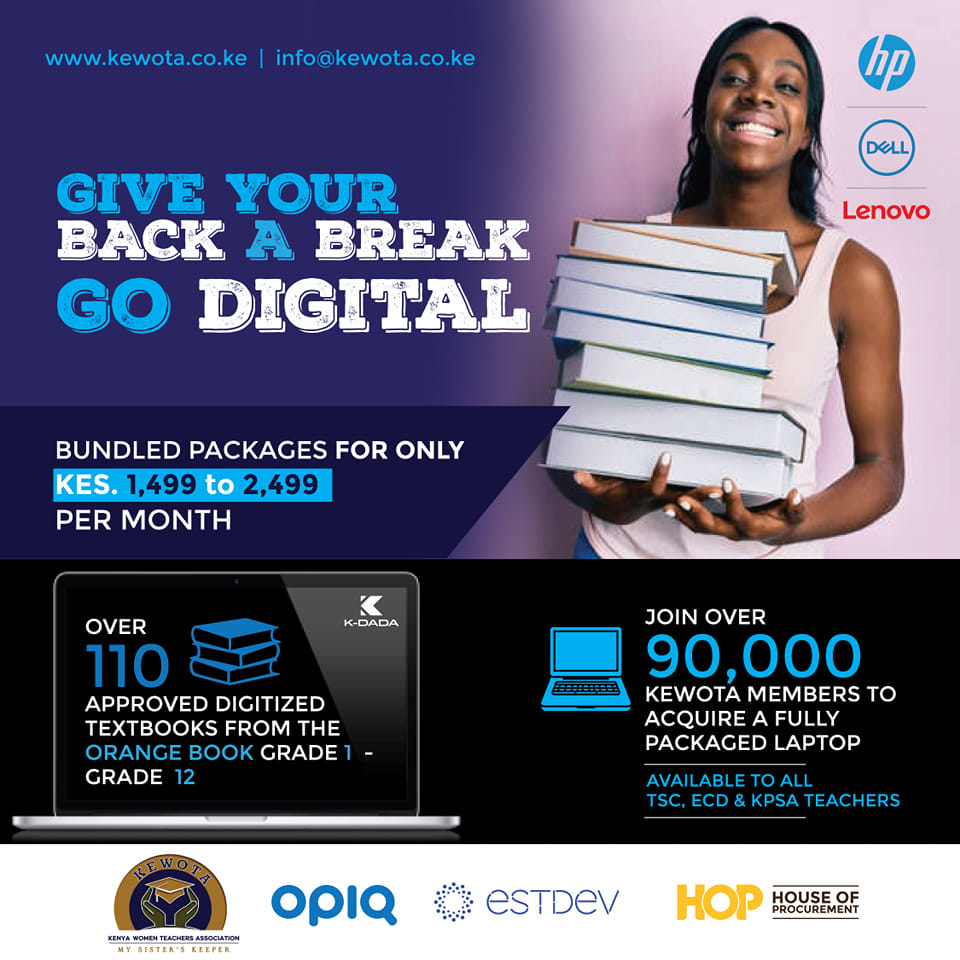

LAPTOP OWNERSHIP PROGRAM - (K-DIGITAL)

The world is moving digital. Digital transformation is happening in all sectors and industries, and it is a change we can not avoid.

The need for adopting technology in Kenya has grown tremendously and is still growing in the digital age. Technology has become a mother of civilizations, social sciences, and arts.

Over the past 20 years, gender and technology-related feminist views have advanced significantly. The long-held belief that technology disciplines are dominated by men has been discredited as more girls and women are beginning to exhibit enthusiasm for technology.

Kenya has paid much more emphasis to women in education, particularly since the government implemented equitable treatment for both girls and women in technical fields in support of the new development objectives. Despite this, women are still underrepresented in digital transformation. KEWOTA is solving this problem through the K-Digital program.

K-DIGITAL

This program provides laptop ownership opportunities for KEWOTA members, and is available through Lipa mdogo mdogo from as low as 2,000 per month. The laptops come equipped with digitized textbooks, TSC online services and access to thousands of self development courses. A member can also choose a modem, and solar power option for areas with low power access.

How it works

- Go through product catalog and select laptop of choice.

- Apply for the lipa mdogo mdogooption and select preferred payment option.

- Select prefered delivery

- Receive laptop and call KEWOTA for activation of digital products.

Benefits

- Earn extra income through our online tutoring platform

- Access KICD approved digital textbooks from your prefered publishers

- Research and generate examples and case studies

- Access free online courses for personal development